ADDITIONAL RESOURCES

Recommended resources on gender diversity:

1. Community Business annual report: “Women on Boards Hong Kong”

Published annually on Women's day in March, the “Women on Boards Hong Kong” report which focuses on Hang Seng Index companies, and provides many figures about the composition of HSI boards. Hong Kong has lagged behind other major financial centers, and in Asia, Singapore and India are catching up and at current rates of improvement will soon surpass Hong Kong. This report is the ninth study of its kind and serves as a credible and authoritative resource to report on the status quo of the gender diversity of Hong Kong's boardrooms today and also to identify trends and track performance over time.

2. Stock Exchange of Hong Kong Limited (the “Exchange”) Resources

Investors should be fully aware of the disclosure requirements and recommendations in the Stock Exchange of Hong Kong Limited (the “Exchange”) consultation paper, “Review of the Corporate Governance Code and related listing rules”, as well as Appendix 14 from the Main Board Listing Rules,“Corporate Governance Code and Corporate Governance report”, and undertake a complete review of the company’s disclosures relating to diversity before any engagement meeting.

In November 2017, the Hong Kong Exchanges and Clearing (HKEX) issued a Consultation Paper on the Review of the Corporate Governance Code including Board Diversity. On 27 Jul 2018, HKEX published its long awaited Consultation Conclusions, placing a stronger emphasis on the importance of Board diversity, including measures encouraging:

strengthen the transparency and accountability of the board and/or nomination committee and election of directors, including Independent Non-Executive Directors (INEDs);

improve transparency of INEDs’ relationships with issuers;

enhance criteria for assessing independence of potential INED candidates;

promoting board diversity, including gender diversity

requiring greater dividend policy transparency.

The Exchange also published “Guidance for Boards and Directors” to help directors carry out their roles more effectively. It covers directors’ duties and board effectiveness, board committees, and board diversity - including gender diversity – as well as corporate governance for weighted voting rights issuers.

Amendments to CG Code and related Listing Rules to take effect 1 January 2019.

3. Credit Suisse: The CS Gender 3000

A key message from Credit Suisse 2019 study “The Credit Suisse Gender 3000: Women in Senior Management” is that gender diversity in the boardroom worldwide has doubled during the decade to over 20%. An interesting conclusion in light of Hong Kong’s challenges is that countries with a lower female representation in senior management and on boards were found to have a wider gender pay gap.

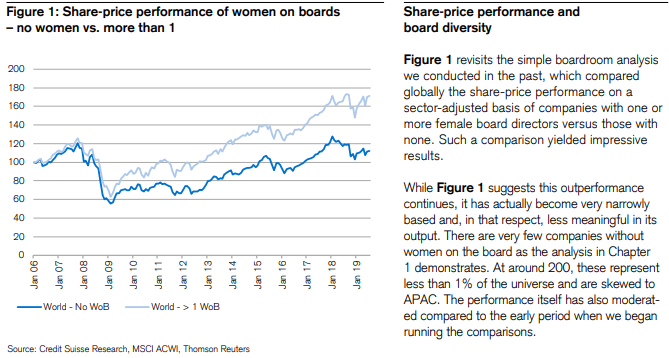

The research concludes that diversity coincided with superior share-price performance, and higher “quality” factor when assessing the corporate-performance characteristics.

4. Delivering through Diversity - Mckinsey & Co. (Jan 2018)

Delivering through Diversity both tackles the business case and provides a perspective on how to take action on I&D to impact growth and business performance. This research reaffirms the global relevance of the correlation between diversity (defined here as a greater proportion of women and ethnically/culturally diverse individuals) in the leadership of large companies and financial out-performance. The research is based on a larger data set of over 1,000 companies covering 12 countries and using two measures of financial performance – profitability (measured as average EBIT margin) and value creation (measured as economic profit margin). As importantly, Mckinsey & Co. studied the I&D efforts of 17 companies representing all major regions and multiple industries to have a more granular view of where in the organization diversity matters most, and crucially, how leading companies have successfully harnessed the potential of I&D to help meet their growth objectives.

Analysis of a global survey of 21,980 firms from 91 countries suggests that the presence of women in corporate leadership positions may improve firm performance. This correlation could reflect either the payoff to nondiscrimination or the fact that women increase a firm’s skill diversity. Women’s presence in corporate leadership is positively correlated with firm characteristics such as size as well as national characteristics such as girls’ math scores, the absence of discriminatory attitudes toward female executives, and the availability of paternal leave. The results find no impact of board gender quotas on firm performance, but they suggest that the payoffs of policies that facilitate women rising through the corporate ranks more broadly could be significant.

6. MSCI Women on boards 2020 progress report (November 2020)

MSCI ESG Research has reported annually on the state of women’s representation on corporate boards since 2009. In 2020, we saw a noticeable slowdown in the rate of increase for female representation on boards, with a gain of only 0.6 percentage points among constituents of the MSCI ACWI Index.

If the trend over the past four years continues it may take until 2029 for women to comprise 30% of corporate boards, and until 2045 to reach 50%..

7. Women on boards: One piece of a bigger puzzle - MSCI (Date not given)

Companies failing to employ women – at any level – in numbers proportional to their availability are by definition limiting the size of their talent pool. In contrast, higher numbers of women, especially in senior positions, might indicate a savvier approach to talent – one that just might promote productivity and economic growth along with gender equality.

8. THE TIPPING POINT: WOMEN ON BOARDS AND FINANCIAL PERFORMANCE - MSCI (Dec 2016)

A growing body of research shows that having three women on a corporate board represents a “tipping point” in terms of influence, which is reflected in financial performance. U.S. companies that began the 2011-2016 period with at least three women on the board experienced median gains in Return on Equity (ROE) of 10 percentage points and Earnings Per Share (EPS) of 37%. In contrast, companies that began the period with no female directors experienced median changes of -1 percentage point in ROE and -8% in EPS over the study period. However, a causal link was not established.

9. PwC 2018 Annual Corporates Directors Survey

Among Top findings of the survey, Directors see value in diversity…but question the motivation.

94% of directors agree that board diversity brings unique perspectives to the boardroom, and 84% say it enhances board performance. But more than half (52%) say board diversity efforts are driven by political correctness, and almost as many (48%) believe shareholders are too preoccupied with the topic. Younger directors are significantly less likely to think that shareholders are too preoccupied with diversity. More than half (52%) of directors over age 60 think so, compared to only 38% of those 60 or under. Some also hint that it’s just a “check-the-box” exercise.

10. Egon Zehnder 2018 Global Board Diversity Tracker

Egon Zehnder, the world's leadership advisory firm, released on December 11,2018 the results of its 2018 Global Board Diversity Tracker. The research shows the accelerating growth seen in female directors in Western Europe is now leveling off, and growth elsewhere remains sluggish, suggesting gender parity on boards may never be reached at the current pace. The study, examining data from 1610 public companies with market caps above 7bn euros in 44 different countries, shows that despite the slow improvement in the number of women on boards, nearly three quarters of all new board positions worldwide still go to men. Action Plan: Egon Zehnder believes the approach of business must change if we are to make real progress on gender diversity:

Pick for Potential - our work with businesses has found that certain personal traits are better indicators of success than a lengthy CV;

Make Leadership Accountable - a focus on diversity has to be a core part of a company's strategy, and an explicit goal set by senior leaders and directors;

Raise Your Ambitions: Focus on Three - until a board achieves the critical mass of three women, little is likely to change. Directors must be proactive in spotting female talent, and consider board term limits or more active turnover;

Train the Board for Success - chairs and directors must prepare the board for the fact that diversity of perspectives and opinions could make doing the work of the board less efficient, but more effective.

The report's full recommendations and findings can be explored and visualized using Egon Zehnder's interactive tools at www.egonzehnder.com/global-board-diversity-tracker.

Alliance for Board Diversity (ABD) and Deloitte study shows women and minorities comprise an all-time high of 34 percent of board seats among Fortune 500 companies, up from 30.8 percent in 2016.

12. Bank of America Merrill Lynch “ESG from A to Z: a global primer”

Board diversity signals better ROE… While performance results have varied over time, BAML found that companies with better scores on board diversity and management diversity saw consistently higher future ROEs than counterparts with lower scores. Companies with more diverse boards (score >50) had higher subsequent 1-year ROEs than companies with less diverse boards (score <50) every year since 2005. Board Diversity was an effective signal of future ROE in almost all sectors, except for Financials. Discretionary and Tech companies have historically been rewarded the most.

Gender diversity = lower earnings risk On all three sub-pillar scores BAML analysed from Refinitiv (board diversity, company policies on diversity/inclusion, and women in management), companies with high ESG scores had lower earnings volatility than companies with low ESG scores on these metrics. Companies with >50 scores on board diversity have also seen consistently lower EPS volatility than companies with <50 scores, every year since 2005.

Consistent premium for board diversity Excluding Financials, companies with 50 or higher scores on Board Diversity have traded at a (growing) premium on Price to Book, relative to companies with scores below 50 on Board Diversity.

To include your research in the Reference Shelf, please email info@boarddiversityhk.org.

13. UK FRC report: “Board diversity and Effectiveness in FTSE350 companies", July 2021

UK FRC published the "Board diversity and Effectiveness in FTSE350 companies" report in July, regarding the relationship between boardroom diversity and financial performance of FTSE350 companies, showing a positive correlation between boardroom gender diversity and improved financial performance metrics such as EBITDA margin after a 3-5 year time lag. A deeper-dive review indicated for FTSE250 companies the effects were larger especially in Year 5 and beyond and supports the Hampton-Alexander Review’s U-Shaped theory. We highlight that report as a lot of the available research take a more short-term time frame (1-2 years). In addition, some of the other links related to positive attributes to mid to long-term growth of corporate value were also intriguing..